Acquiring a business loan is often hard, and a number of other factors — Price tag, velocity, repayment schedule — can Participate in a task in deciding which products is ideal for you. Let's aid you thru the process.

We use cookies to improve your encounter on our website. May well we use internet marketing cookies to demonstrate customized adverts? Deal with all cookies

On The complete, in case you’re planning to apply for a SBA 504 loan, you need to be able to slide into one of the broader Neighborhood progress or public policy groups, such as improving upon the area overall economy or stimulating new cash flow and expense.

Startups working for under a year can consider other small-business lending possibilities. The top business loan for you'll rely on various components, which include:

Loan assures are what give personal lenders The boldness to supply SBAs with decrease payments and more flexible terms.

With QuickBridge, you can decide the way you’d wish to allocate the funds out of your small business loan. We don’t just offer funding. We provide lending alternatives which make for a much better, smarter small business loan.

Now that we’ve reviewed that illustration as well as the caveats that come along with the SBA 504 loan software, Enable’s go over The standard options of those loans, starting up with loan quantity.

So, if you're thinking that an SBA 504 loan is correct for your business, you’ll want to find a lender to start out the applying procedure. Obviously, as we’ve reviewed at duration regarding this application, this can contain dealing with a financial institution or other SBA lending associate, as well as a CDC.

Once you’ve picked out a suggestion, we’ll ask for ultimate documentation and verify. We’ll assessment and come back having a last provide and loan settlement. Upon signing, you’ll get The cash you will need for the business!

To qualify for an FSA loan, you’ll require to fulfill marketplace-distinct requirements and show which click here you’ll be able to repay your funding.

The material of this text is delivered for informational purposes only. You need to usually get hold of impartial business, tax, money, and authorized advice before you make any business final decision.

Should you’re not emotion much like the SBA 504 loan is right for you, there are various other SBA loan programs to take into account as you select what’s most effective to your business.

We arrived at out to Zions Bank to see if there have been any rewards to dealing with them during the SBA loan system. Here is what they instructed us:

But, if you want far more instant access to cash, you may still have the ability to qualify for just a business loan with lousy credit rating.

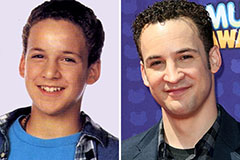

Ben Savage Then & Now!

Ben Savage Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!